Grunnleggende statistikk

| Institusjonelle eiere | 158 total, 158 long only, 0 short only, 0 long/short - change of % MRQ |

| Gjennomsnittlig porteføljeallokering | 0.2717 % - change of % MRQ |

| Institusjonelle aksjer (Long) | 21 251 777 (ex 13D/G) |

| Institusjonell verdi (Long) | $ 417 809 USD ($1000) |

Institusjonelt eierskap og aksjonærer

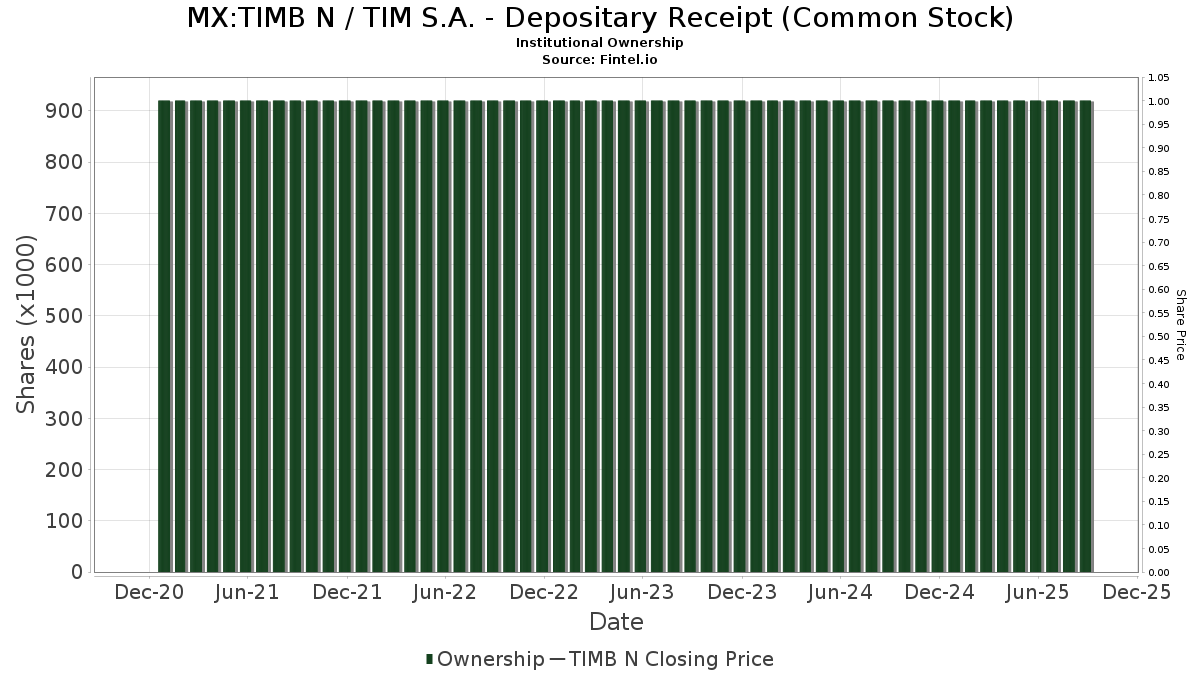

TIM S.A. - Depositary Receipt (Common Stock) (MX:TIMB N) har 158 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 21,251,777 aksjer. De største aksjonærene inkluderer Robeco Institutional Asset Management B.V., Arrowstreet Capital, Limited Partnership, Renaissance Technologies Llc, Macquarie Group Ltd, DEMAX - Delaware Emerging Markets Fund Class A, BlackRock, Inc., UBS Group AG, Crossmark Global Holdings, Inc., State Street Corp, and Vanguard Group Inc .

TIM S.A. - Depositary Receipt (Common Stock) (BMV:TIMB N) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-27 | NP | RMEAX - Aspiriant Risk-Managed Equity Allocation Fund Advisor Shares | 5 938 | 0,00 | 119 | 29,35 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 64 187 | 1 291 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 380 158 | 15,28 | 7 645 | 48,11 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 380 | 0 | ||||||

| 2025-05-07 | 13F | Kapitalo Investimentos Ltda | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 57 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 20 637 | 415 | ||||||

| 2025-08-12 | 13F | American Century Companies Inc | 445 578 | 26,44 | 8 961 | 62,47 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 1 993 | 182,70 | 31 | 287,50 | ||||

| 2025-06-25 | NP | VRAI - Virtus Real Asset Income ETF | 10 311 | −14,95 | 172 | 6,88 | ||||

| 2025-05-15 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 32 773 | 519 | ||||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 48 333 | 9,86 | 972 | 41,13 | ||||

| 2025-08-21 | NP | MEMSX - Mercer Emerging Markets Equity Fund Class I | 21 705 | 63,22 | 436 | 109,62 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 19 268 | 18,56 | 389 | 53,15 | ||||

| 2025-05-07 | 13F | LPL Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 56 685 | 10,12 | 1 140 | 41,49 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 49 | −76,44 | 1 | −100,00 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 6 269 | 97,45 | 126 | 157,14 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 410 073 | −3,02 | 8 247 | 24,62 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 349 827 | 33,64 | 7 035 | 71,75 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-23 | 13F | Pinnacle Bancorp, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 337 616 | −67,70 | 6 789 | 42 331,25 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 544 956 | 0,33 | 10 959 | 28,93 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 37 668 | −21,31 | 759 | 1,20 | ||||

| 2025-08-14 | 13F | Aprio Wealth Management, LLC | 28 187 | −8,06 | 567 | 18,16 | ||||

| 2025-08-29 | NP | GAUAX - The Gabelli Utilities Fund Class A | 34 000 | 0,00 | 684 | 28,38 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 13 449 | 941,75 | 270 | 1 250,00 | ||||

| 2025-08-14 | 13F | Goldentree Asset Management Lp | 100 000 | 0,00 | 2 011 | 28,50 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 175 | 4 | ||||||

| 2025-08-29 | NP | GATAX - The Gabelli Asset Fund Class A | 18 700 | 0,00 | 376 | 28,77 | ||||

| 2025-06-26 | NP | SGIDX - Steward Global Equity Income Fund Class A | 336 371 | 7,11 | 5 611 | 34,92 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Quantbot Technologies LP | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 15 349 | 309 | ||||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 19 249 | 387 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 975 508 | 24,01 | 19 617 | 59,35 | ||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 25 288 | 48,87 | 509 | 155,28 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Barclays Plc | 16 695 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Beck Bode, LLC | 21 347 | 429 | ||||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 44 883 | −4,67 | 903 | 22,55 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 200 968 | 0,00 | 4 030 | 28,10 | ||||

| 2025-07-28 | NP | AVEM - Avantis Emerging Markets Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 358 544 | 27,14 | 6 099 | 56,48 | ||||

| 2025-08-26 | NP | Delaware Vip Trust - Delaware Vip Emerging Markets Series Standard Class | 134 614 | −13,15 | 2 707 | 11,63 | ||||

| 2025-06-27 | NP | DAINX - Dunham International Stock Fund Class A | 5 447 | 0,00 | 91 | 25,00 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 50 677 | −42,20 | 1 019 | −25,73 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 3 482 294 | 10,80 | 70 029 | 42,37 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | |||||

| 2025-06-02 | 13F/A | Deutsche Bank Ag\ | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Amundi | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 10 813 | 217 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 21 | −99,14 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 2 064 | 303,12 | 0 | |||||

| 2025-05-14 | 13F | SPX Equities Gestao de Recursos Ltda | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 11 | −52,17 | 0 | |||||

| 2025-06-26 | NP | DFEM - Dimensional Emerging Markets Core Equity 2 ETF | 5 734 | 0,00 | 96 | 26,67 | ||||

| 2025-08-28 | NP | SPEM - SPDR(R) Portfolio Emerging Markets ETF | 503 177 | 9,90 | 10 119 | 41,21 | ||||

| 2025-05-19 | 13F/A | Jane Street Group, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | State Street Corp | 601 618 | 4,19 | 12 539 | 38,17 | ||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 90 415 | 0,00 | 1 818 | 28,57 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 14 902 | 1 541,19 | 236 | 1 585,71 | ||||

| 2025-07-28 | NP | AVSE - Avantis Responsible Emerging Markets Equity ETF | 6 815 | 13,28 | 116 | 38,55 | ||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 1 679 579 | −1,94 | 33 776 | 26,00 | ||||

| 2025-06-24 | NP | EMRSX - JPMorgan Emerging Markets Research Enhanced Equity Fund Class R6 | 135 158 | −3,54 | 2 254 | 21,51 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 2 072 | 42 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 031 | 12,31 | 21 | 42,86 | ||||

| 2025-08-01 | 13F | Banco Santander, S.A. | 52 489 | 1 056 | ||||||

| 2025-06-26 | NP | DFSE - Dimensional Emerging Markets Sustainability Core 1 ETF | 1 740 | 0,00 | 29 | 26,09 | ||||

| 2025-04-29 | 13F | Td Private Client Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | NSI - National Security Emerging Markets Index ETF | 752 | 38,75 | 13 | 71,43 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4 858 | −1,62 | 98 | 25,97 | ||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 35 267 | −12,79 | 1 | |||||

| 2025-07-28 | NP | AVXC - Avantis Emerging Markets ex-China Equity ETF | 3 781 | 37,24 | 64 | 68,42 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 19 313 | −18,60 | 388 | 4,58 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 691 | 0,00 | 12 | 22,22 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 73 | −86,15 | 1 | −83,33 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 278 641 | −23,71 | 5 603 | −1,96 | ||||

| 2025-08-26 | NP | GLBIX - Leuthold Global Fund Institutional Class | 5 495 | 111 | ||||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 4 776 | −37,87 | 96 | −20,00 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 40 818 | 0,00 | 821 | 28,53 | ||||

| 2025-08-26 | NP | SBHEX - Segall Bryant & Hamill Emerging Markets Fund Retail Class | 3 400 | −63,04 | 68 | −56,96 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 291 | −58,35 | 26 | −47,92 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-25 | NP | DEMAX - Delaware Emerging Markets Fund Class A | 1 244 820 | 0,00 | 21 174 | 23,08 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 8 658 | 7,75 | 174 | 40,32 | ||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 1 989 366 | −5,70 | 40 006 | 21,18 | ||||

| 2025-05-15 | 13F | Jain Global LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | PineBridge Investments, L.P. | 126 436 | 10,02 | 2 543 | 41,38 | ||||

| 2025-08-14 | 13F | Fmr Llc | 2 990 | 5,10 | 60 | 36,36 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 4 099 | 1,41 | 82 | 30,16 | ||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 72 269 | 22,90 | 1 453 | 57,93 | ||||

| 2025-07-25 | 13F | Meritage Portfolio Management | 189 218 | −2,67 | 3 805 | 25,08 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | QEMM - SPDR MSCI Emerging Markets StrategicFactors ETF | 402 | −3,83 | 8 | 33,33 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 90 915 | −11,38 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 8 852 | −27,78 | 178 | −6,81 | ||||

| 2025-04-28 | 13F | First Horizon Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 33 796 | 680 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 23 980 | 8,92 | 482 | 40,12 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3 628 | 5,04 | 73 | 33,33 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 19 224 | 387 | ||||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 16 572 | 0,00 | 333 | 28,57 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Hong Kong Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 36 288 | −96,57 | 730 | −95,59 | ||||

| 2025-05-14 | 13F | Custom Index Systems, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DFAE - Dimensional Emerging Core Equity Market ETF | 22 460 | 56,62 | 375 | 97,88 | ||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 152 326 | −1,10 | 3 063 | 27,10 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 30 840 | 27,21 | 620 | 63,59 | ||||

| 2025-08-12 | 13F | Summit Global Investments | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 72 | −75,34 | 1 | −75,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 314 131 | −51,53 | 6 317 | −37,71 | ||||

| 2025-08-07 | 13F | Altman Advisors, Inc. | 120 430 | 1,49 | 2 436 | 23,09 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 7 000 | 0,00 | 0 | |||||

| 2025-08-20 | NP | REMG - Emerging Markets Equity Active ETF | 5 145 | 103 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 130 | 150,00 | 3 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 10 018 | 117,74 | 201 | 179,17 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 37 916 | 571,44 | 762 | 765,91 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 83 003 | −0,93 | 1 669 | 27,31 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 10 329 | 0 | ||||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3 139 | 3,67 | 63 | 34,04 | ||||

| 2025-08-14 | 13F | VPR Management LLC | 20 350 | 0,00 | 409 | 28,62 | ||||

| 2025-05-15 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 76 | 0,00 | 2 | 0,00 | ||||

| 2025-08-08 | 13F | Altfest L J & Co Inc | 24 794 | 499 | ||||||

| 2025-08-29 | NP | Gabelli Multimedia Trust Inc. | 3 800 | 0,00 | 76 | 28,81 | ||||

| 2025-08-08 | 13F | Creative Planning | 21 511 | 9,21 | 433 | 40,26 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 56 332 | 24,04 | 1 133 | 59,44 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 645 679 | 3,41 | 12 985 | 32,88 | ||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 20 903 | 420 | ||||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 83 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Qtron Investments LLC | 26 321 | 50,72 | 529 | 93,77 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 5 607 | 31,68 | 113 | 69,70 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 189 | 0,00 | 4 | 50,00 | ||||

| 2025-06-23 | NP | UBPIX - Ultralatin America Profund Investor Class | 3 172 | −6,15 | 53 | 18,18 | ||||

| 2025-05-06 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 80 202 | −26,55 | 1 613 | −5,62 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 54 | 8,00 | 1 | |||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 6 634 | 133 | ||||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1 681 686 | 3,46 | 33 819 | 32,95 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 10 290 | 207 | ||||||

| 2025-07-28 | NP | AVEEX - Avantis Emerging Markets Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 18 131 | 0,00 | 308 | 23,20 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 36 499 | 49,68 | 734 | 92,39 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 117 | 0,00 | 2 | 100,00 | ||||

| 2025-04-29 | NP | SGLIX - SGI Global Equity Fund Class I Shares | 47 011 | −1,94 | 650 | 5,02 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 90 934 | −11,22 | 1 829 | 14,04 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 6 233 | 27,78 | 125 | 64,47 | ||||

| 2025-06-26 | NP | DEXC - Dimensional Emerging Markets ex China Core Equity ETF | 2 760 | 14,05 | 46 | 43,75 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 411 516 | −65,45 | 8 276 | −55,60 | ||||

| 2025-05-08 | 13F | Natixis Advisors, L.p. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Advisors Preferred, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 32 | 23,08 | 1 | |||||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Gabelli Funds Llc | 102 575 | 0,00 | 2 063 | 28,47 | ||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 4 210 | 85 | ||||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 23 | 0 | ||||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 4 | −42,86 | 0 | |||||

| 2025-06-11 | NP | SLANX - DWS Latin America Equity Fund Class A | 72 300 | −6,23 | 1 206 | 18,14 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 14 134 | 284 | ||||||

| 2025-06-25 | NP | VVIFX - Voya VACS Series EME Fund | 37 700 | 0,00 | 629 | 25,85 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 80 718 | 30,06 | 1 623 | 67,15 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 3 956 | 19,34 | 80 | 51,92 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 17 065 | −0,88 | 343 | 27,51 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2 865 | −0,59 | 0 | |||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 31 449 | −6,30 | 632 | 20,38 | ||||

| 2025-08-29 | NP | Gabelli Equity Trust Inc | 46 075 | 0,00 | 927 | 28,43 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 20 871 | 21,01 | 420 | 55,76 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 2 046 | 0,00 | 41 | 28,13 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 580 | 2,65 | 12 | 37,50 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 58 600 | −1,01 | 1 178 | 27,21 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 66 237 | 6,82 | 1 331 | 37,22 | ||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 203 | 0,00 | 3 | 50,00 | ||||

| 2025-07-28 | NP | AVES - Avantis Emerging Markets Value ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 37 009 | 11,82 | 630 | 37,64 | ||||

| 2025-08-14 | 13F | UBS Group AG | 672 306 | −7,96 | 13 520 | 18,27 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DEHP - Dimensional Emerging Markets High Profitability ETF | 7 420 | 57,20 | 124 | 98,39 | ||||

| 2025-08-11 | 13F | EntryPoint Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2 060 | 188,11 | 41 | 272,73 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 14 095 | 40 171,43 | 283 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 29 937 | 7,16 | 606 | 36,26 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Schroder Investment Management Group | 439 346 | −7,80 | 8 835 | 20,17 | ||||

| 2025-08-08 | NP | QGBLX - Quantified Global Fund Investor Class | 160 448 | 2 780,57 | 3 227 | 3 608,05 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 21 442 | 52,05 | 417 | 86,16 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 150 352 | 54,96 | 3 024 | 99,14 | ||||

| 2025-04-28 | 13F | Private Trust Co Na | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | WealthCollab, LLC | 645 | 0,00 | 13 | 20,00 |